|

By Tim Hayes The big winners from the new congressional tax bill are corporations, which will see their tax rates reduced from 35 percent to 21 percent while keeping most of their deductions.*1 However, second but little-talked-about winners are state governments, mainly in those 40 or so states that align their tax codes with the federal system. In those states, any person or couple who loses deductions and exemptions at the federal level may also lose them at the state level. When you lose deductions, your taxable income goes up, and, unlike the federal government, state income tax rates were not a part of the federal tax cut. How big a windfall will states see? Colorado estimates its tax revenue will jump anywhere from $196 million to $340 million per year.*2 Maryland predicts an increase of hundreds of millions of dollars per year, in part from people losing deductions. Plus, any Maryland taxpayers who take advantage of the new higher federal standard deduction must file their Maryland state taxes using the lower Maryland standard deduction.*3 New England, Connecticut, Maine, and Vermont are the states in which parts of the state tax code mimic that of the Fed, while Massachusetts uses its own definitions of income and deductions, so any impact on state taxes there will be minimal. New Hampshire is one of nine states with no state income tax. So, whether individual taxpayers pay more or fewer state taxes depends on their states’ respective definitions of income, deductions, and exemptions. However, taxpayers in some states will probably end up paying both higher federal and state taxes. The benefit of these tax cuts to the economy will depend on whether companies use the added cash from the tax savings for investment, as only investment adds directly to Gross Domestic Product (GDP). Paying down debt subtracts from GDP. Dividends and stock buybacks have a positive impact on GDP, but they have a smaller, less direct impact. Should you make any changes to your financial planning? With the near-doubling of the standard deduction and the lowering of the tax rates, many people will soon pay less in federal income taxes, which makes it a good time for employees with access to employer-sponsored retirement plans such as 401(k), 403(b), or 457 to start one. Also, if the plan provides a Roth option, younger employees should consider using that option instead of the traditional tax-deductible contribution. Employees already participating in their employers’ plans might want to increase their 401(k) or 403(b) payroll deductions—especially those employees who need to save more for retirement and will lose deductions because of the new law’s $10,000 limit on the deductibility of state and local taxes (SALT).*4 Bonds Tax-free bonds might make sense over US Treasury bonds for high earners who lose deductions and who live in states that tie their state tax codes into federal tax laws, especially if the states that receive that windfall use it to shore up their finances. Stocks The new law makes no change to the capital gains rate that individuals pay, but it dramatically reduces the corporate tax rate that companies pay. This leaves businesses with more cash, which, depending on how they use it, could push the stock market even higher. 529 Plans The new law allows the use of 529 college savings plans for tuitions at not only colleges but also private and religious elementary, middle, and high schools.5 However, given the fewer state deductions, the new federal tax law will leave individuals with, make sure you carefully examine your state’s 529 plan to see if it contains additional tax benefits. Footnotes: *1 Bloomberg. “These Are the Corporate Winners and Losers in the GOP’s Final Tax Bill.” Fortune, December 16, 2017. http://fortune.com/2017/12/16/gop-tax-bill-winners-and-losers/ *2 Eason, Brian. “Why the Newly Passed Federal Tax Cut Will Mean Higher State Taxes for Some in Colorado.” The Denver Post, December 20, 2017. https://www.denverpost.com/2017/12/20/federal-tax-reform-colorado-state-taxes/ *3 Hicks, Josh. “Hogan Pledges to Protect Maryland Residents From the Higher State Taxes Due to GOP Tax Bill.” The Washington Post, December 20, 2017. https://www.washingtonpost.com/local/md-politics/hogan-promises-plan-to-protect-marylanders-from-higher-taxes-under-congressional-measure/2017/12/20/7ac2a548-e59c-11e7-833f-155031558ff4_story.html?utm_term=.aa4da6427e31 *4 Gleckman, Howard. “What the Tax Bill’s Curbs on the SALT Deduction Would Mean for Itemizers.” Forbes, December 21, 2017. https://www.forbes.com/sites/beltway/2017/12/21/what-the-tax-bills-curbs-on-the-salt-deduction-would-mean-for-itemizers/#df7f4c04918b *4 Lieber, Ron. “The Private School Tax Break in the Middle-Class Tax Bill.” The New York Times, November 8, 2017. https://www.nytimes.com/2017/11/08/your-money/the-private-school-tax-break-in-the-middle-class-tax-bill.html The opinions of Tim Hayes and not necessarily those of Cambridge Investment Research or this publication. They are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Securities offered through Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Federally registered investment advisor, 39 Braddock Park #5, Boston, MA 02116 | 126 Horseneck Road, S. Dartmouth, MA 02748.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

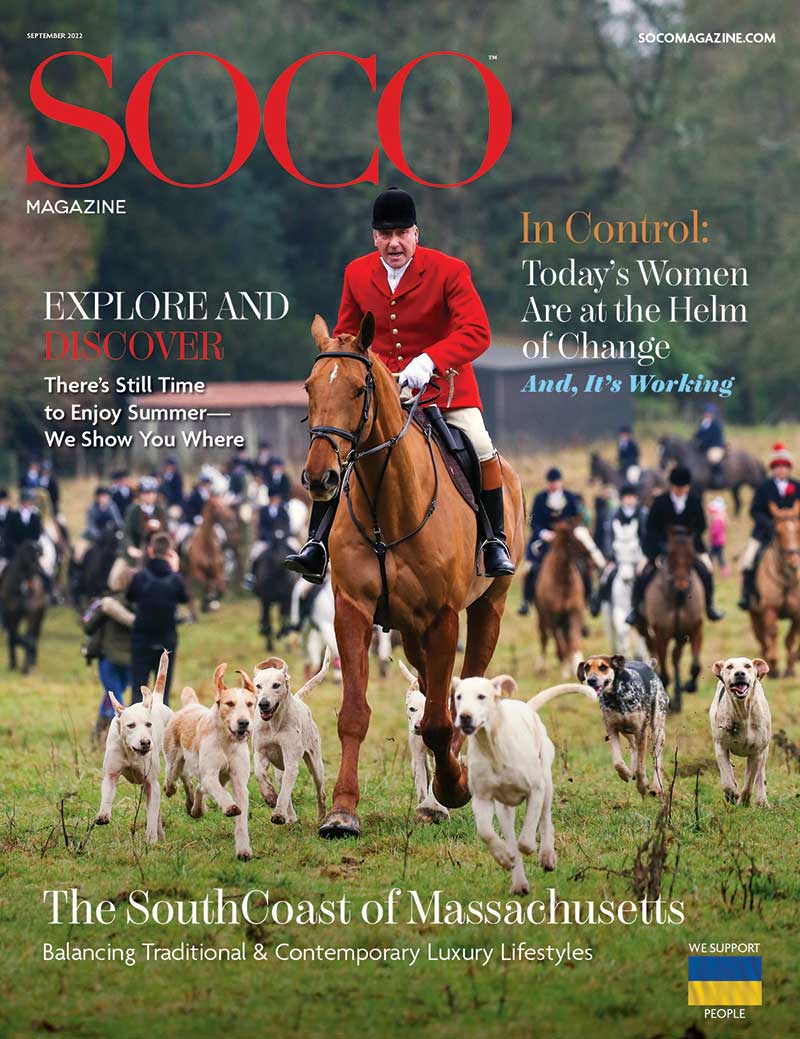

Click the cover above to receive a free digital subscription

Archives

June 2022

Categories

|