|

By Tim Hayes

Mark Twain supposedly said, “If you don’t read the newspaper, you are uninformed. If you do read the newspaper, you are misinformed.” (I’m not sure what he would say about this article.) Anyone reading today’s financial press would think the US economy is accelerating —finally taking off from its post-financial crisis, lackluster performance to what Tom Brokaw called “a roaring economy” on a recent episode of Meet the Press. However, the numbers do not bear Tom or much of the media out. For example, in 2017, GDP growth was 2.3 percent, which appears to be consistent with only some of the years of the previous administration. In 2010, it rose 2.5 percent; 2011, 1.6 percent; 2012, 2.2 percent; 2013, 1.7 percent; 2014, 2.6 percent; 2015, 2.6 percent; and 2016, 1.5 percent.1 Moreover, corporation and consumer borrowing—the lifeblood of future economic growth—slowed in 2017, while consumer confidence grew to 122.1 at the end (December) of 2017, as reported by the Conference Board, slightly below the 17-year record set in November in the same year. Companies increased their borrowing by just 1 percent, compared to a 6 percent increase in 2016.2 Borrowing by consumers was up 5 percent, but that, too, was below the 7 percent growth in 2016.3 And, at 2.4 percent, the lowest saving rate since 2005, consumers might soon run out of gas.4 With talk of a new tax plan and America’s most high-profile firms doling out higher wages and bonuses (a direct result of bringing back trillions of dollars to the US), it seems to be a game of wait and see. Hiring appeared to slow in 2017. According to William J. Wiatrowski, acting commissioner of the Bureau of Labor Statistics, “Employment growth has averaged 174,000 per month thus far this year, compared with an average monthly gain of 187,000 in 2016.”5 That is understandable, as we are late in this economic cycle, and our low unemployment means fewer jobs to fill. However, the US Department of labor (February 2, 2018) did revise the original estimate and reported that “total nonfarm payroll employment increased by 200,000 in January, [with] the unemployment rate unchanged at 4.1 percent.” The department found that hiring continued to trend up in construction, food services and drinking places, health care, and manufacturing. Why do the media keep saying the economy is doing better? Perhaps it was the stock market’s recent performance (before the correction—a result of bad plays with questionable investment tools and strategies). The stock market flourished during the previous recovery, while GDP growth remained lackluster; there are some indications that it may come back in a perfect storm of expansion and a market turnaround. Could it be that the media follows the lead of President Trump, who, unlike his predecessor, seems more comfortable promoting the markets and the economy? Or is there an underlying—even progressive —increase in optimism by US businesses? Alternatively, it may be the rising consumer confidence6 and the ISM manufacturing and purchasing indexes fueling the media reports. These are merely surveys—testing the pulse of the public—and until those polls translate into more borrowing, continued growth is questionable. With interest rates nudging upward, and with consumers and corporations heavily in debt, it’s difficult to predict whether we will witness increases in borrowing. Rising rates could be a sign that the economy is accelerating, but it could also signify insufficient buyers to purchase the $1 trillion of Treasury bonds needed to be sold to fund the rising deficit coming, in part from the tax cuts and the Federal Reserve reducing its balance sheet. Plus, as rates increase, bonds become attractive to those willing to bail out of individual stocks or mutual funds. Is the media doing harm? The new hype on making “fast money” is focused on the bitcoin and the cryptocurrency phenomenon. Bitcoin went from $2,000 in May of 2017 all the way up to $19,345 on December 16, 2017, returning to $7,290. In six months Bitcoin went up 867 percent, then (in little over a month) dropped by 62 percent, and is probably heading back below $2,000. This new “invention,” as troubling as it appears, has taken the stage and will continue to gather interest. The question remains, should the gyrations of this investment tool be shared with an unsuspecting investor? The chicken or the egg? It will be interesting to see if it is the media driving consumer confidence and other survey results. It will take employment numbers to climb, with those who find themselves unemployed, to dwindle to the lowest levels in decades. Once there, we will be able to determine what is the cause and effect of a robust economy and who’s simply cheerleading. Questions abound: Will high levels of confidence, followed by tax cuts, lead to an accelerating economy? And how will the media (as well as the president) present the good news if our lives improve, or explain why the markets and the well-being of the nation stagger with flu-like symptoms? Keep an eye out for the first-quarter GDP number. It has been very weak throughout this recovery, in part from a hangover as consumers retrench from overspending during the holidays. If it is weak again, the media may have to reevaluate their “surging economy” story. 1 Amadeo, Kimberly. “U.S. GDP by Year Compared to Recessions and Events.” The Balance, January 30, 2018. https://www.thebalance.com/us-gdp-by-year-3305543 2 Federal Reserve Bank of St. Louis. “Commercial and Industrial Loans, All Commercial Banks.” FRED® Economic Data, St. Louis Fed. https://fred.stlouisfed.org/series/BUSLOANS 3 Federal Reserve Bank of St. Louis. “Consumer Loans at all Commercial Banks.” FRED® Economic Data, St. Louis Fed. https://fred.stlouisfed.org/series/CONSUMER 4 Bartash, Jeffry. “Consumer Spending Hits 6-Year High ¬– As Americans Cut Savings to 12 Year Low.” Market Watch, January 29, 2018. https://www.marketwatch.com/story/consumer-spending-hits-6-year-high-as-americans-cut-savings-to-12-year-low-2018-01-29 5 Chappell, Bill, November Jobs Report. “Employment Adds 228,000 Jobs; Unemployment Steady.” NPR, December 8, 2017. https://www.npr.org/sections/thetwo-way/2017/12/08/569370879/november-jobs-report-economy-adds-228-000-jobs-unemployment-steady 6 Sheetz, Michael. “Consumer Confidence Jumps as Americans Expect 2017 Momentum to Continue.” CNBC, January 30, 2018. https://www.cnbc.com/2018/01/30/us-january-consumer-confidence-index-125-point-4-vs-123-point-1-expectations.html These are the opinions of Tim Hayes and not necessarily those of Cambridge Investment Research or this publication. They are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Securities offered through Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Federally registered investment advisor, 39 Braddock Park #5, Boston, MA 02116 | 126 Horseneck Road, S. Dartmouth, MA 02748.

0 Comments

Leave a Reply. |

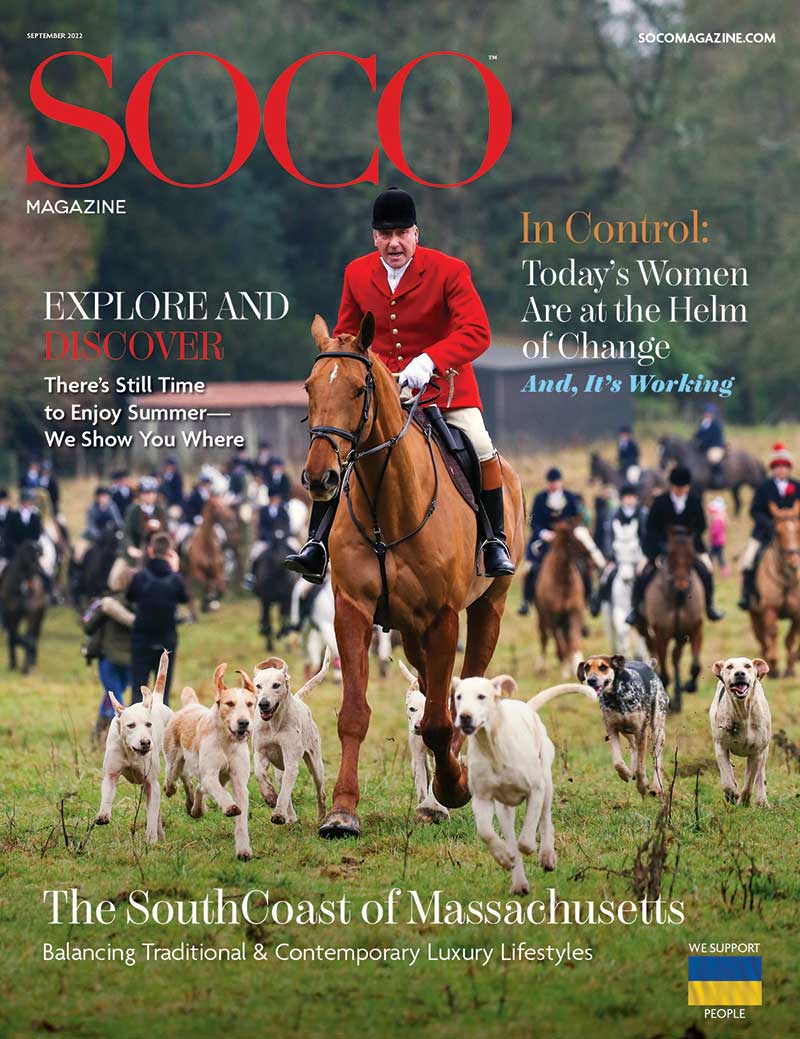

Click the cover above to receive a free digital subscription

Archives

June 2022

Categories

|